Forced Savings

One of the big banks has a voluntary program available that transfers $100 each month from your checking account to your savings account. In five years, the account owner would have over $5,000 because of a type of forced savings.

|

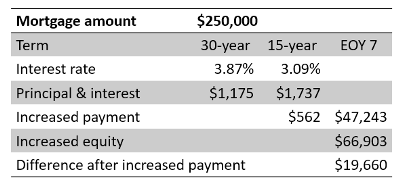

Similarly, when a person buys a home with a standard amortizing loan, each month, a part of the payment is used to reduce the principal loan amount. Amazingly, over $4,000 would be applied toward the principal in the first year of a $250,000 mortgage at 4% for 30 years. In five years, the loan amount would be reduced by almost $25,000 through normal payments.

The other dynamic that is in play is that while the unpaid balance is being reduced, appreciation causes the value to increase. The difference between the two makes the equity grow even faster. Three percent appreciation on a $250,000 home would increase its value in five years by almost $40,000.

A 30-year mortgage of $250,000 will be paid for in 30 years. At an average of 3% appreciation, the asset would be worth about $600,000. If you continue to rent, the asset belongs to your landlord instead.

Many experts believe that the homeowner benefits from the forced savings of amortization and the leveraged growth that takes place in the investment. It has been observed in the tri-annual Consumer Finance Survey by the Federal Reserve Board that homeowners' net worth is considerably higher than that of renters.