It Isn't Final Until It's Funded

Mortgage approval isn’t final until it’s funded. Things can change prior to the loan being closed that can affect a pre-approval such as changes in the borrowers’ financial situation or possibly, factors beyond their control like interest rate changes.

Good advice to buyers is to do nothing that can affect your credit report until the loan closes. Opening new credit cards, taking on new debt for a car or furniture or changing jobs could affect the lender’s decision if they believe you may no longer be able to repay the loan.

The benefits of buyer’s pre-approval are definitive: it saves time, money and removes the uncertainty of knowing whether the buyer is qualified. The direct benefits include:

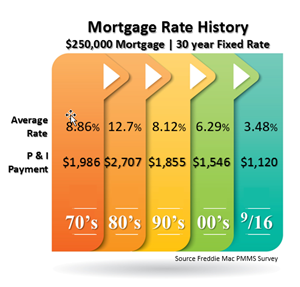

- Amount the buyer can borrow - decreases as interest rates rise

- Looking at “Right” homes - price, size, amenities, location

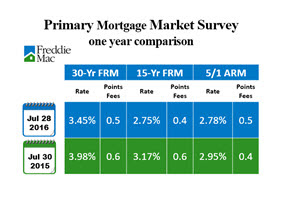

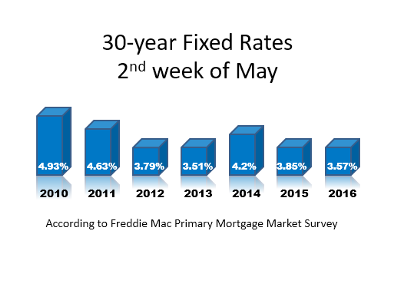

- Find the best loan - rate, term, type

- Uncover credit issues early - time to cure possible problems

- Bargaining power - price, terms, & timing

- Close quicker - verifications have been made

It is a very common practice for mortgage lenders to require income and bank verifications and to re-run the borrowers’ credit one final time just prior to closing. Mortgage approval isn’t final until it’s funded.